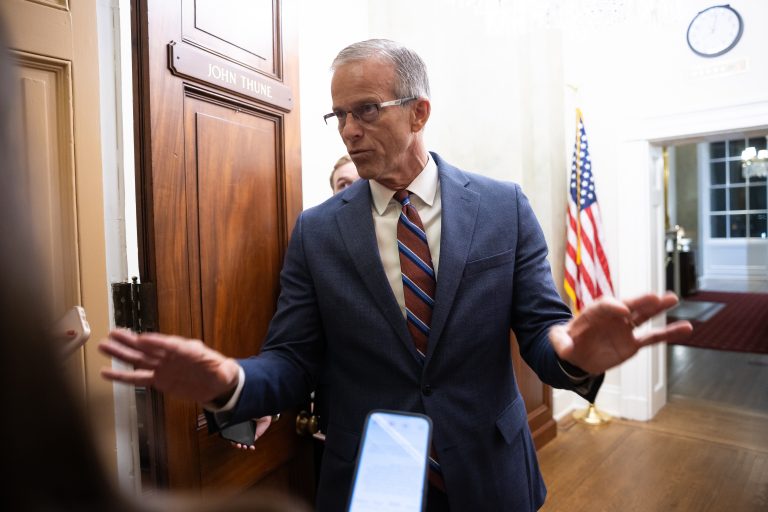

The House plans to vote Wednesday to repeal a provision that could award eight GOP senators hundreds of thousands of dollars for having their phone records seized without their knowledge during a Biden-era probe. Senate Majority Leader John Thune, who secured the measure, is standing his ground.

“The House is going to do what they are going to do with it,” he told reporters Tuesday night. “It doesn’t apply to them.”

But many senators from both parties are eager to roll back the legislative language they didn’t know Thune secretly negotiatedwith Senate Minority Leader Chuck Schumer in the government funding package that ended the longest shutdown in history last week. Republicans could revolt if leadership doesn’t give them a vote to overturn it.

In interviews Tuesday with nearly a dozen lawmakers, confusion, frustration and anger ran rampant about what has quickly become branded as a politically toxic, taxpayer-funded windfall for a select few. Sen. John Kennedy (R-La.) went so far as to quip there could be “some stabbings” at the Senate GOP’s weekly lunch Wednesday when the topic will inevitably get discussed.

“Whoever put this in had an obligation to tell us about it, and they didn’t,” said Kennedy. “There’s something called trust and good faith around here.”

Even Schumer conceded the widely unpopular language should ultimately be scrapped.

“The bottom line is, Thune wanted the provision and we wanted to make sure that at least Democratic senators were protected from [Attorney General Pam] Bondi and others who might go after them,” he said Tuesday. “But I’d be for repealing all of it and I hope that happens,” he told reporters.

It’s not clear whether it’s too late to reverse course in the Senate.

The provision at issue, which President Donald Trump signed into law last week, would award senators $500,000 or more if they discover their electronic records were seized without notification.

In seeking to attach it to the funding bill, Thune was directly responding to furor from several Senate Republicans eager for retribution against former special counsel Jack Smith, who obtained the phone records for at least eight Republican senators during his investigation into Trump’s efforts to overturn the results of the 2020 election.

Thune in an interview acknowledged that members would indeed discuss the issue at lunch Wednesday but reiterated that he personally was not having second thoughts about including the measure in the funding deal.

“It’s designed to protect United States senators,” Thune said. “We have a number of people who are interested in making sure that that sort of thing has a consequence if that kind of weaponization of the government along the lines of what Jack Smith did is ever employed again in the future.”

Senate Commerce Chair Ted Cruz (R-Texas), who claims he was targeted by the Smith probe, praised Thune for including the language. Senate Budget Chair Lindsey Graham (R-S.C.), who is confirmed to have had his records subpoenaed during the Smith investigation, has said he plans to take advantage of the provision to make it “so painful” for those involved.

Some Senate Republicans admitted they hope the language is preserved. Sen. Eric Schmitt (R-Mo.) said he wanted the provision expanded to let a broader range of parties sue to show “how corrupt Jack Smith is.”

It’s far from certain disgruntled lawmakers would make it easy for Thune to move a standalone bill to revoke the provision, even if he decides he wants to — they could insist on controversial amendments or make the voting process drawn-out and disruptive. Nor is it clear Republicans would allow the provision to be stripped in a subsequent government funding bill.

There’s far less hand-wringing in the House, where members were criticizing the language before they even voted on the Senate-passed funding bill last Thursday.

The House Wednesday evening is expected to easily pass a bill to repeal the payout provision with support from Speaker Mike Johnson and House Judiciary Chair Jim Jordan, who is working to get Smith to sit for a transcribed interview before his committee.

In the Senate, several lawmakers signaled Tuesday night they were anxious to distance themselves from the new policy and wanted to follow the House’s lead.

“I’m going to support repealing it,” said Sen. Markwayne Mullin (R-Okla.), the chair of the legislative branch appropriations subcommittee.

He added he was not alerted about the language until after he already voted for the funding package last week and that he later received an “apologetic” call from GOP leadership over how the matter was handled. Thune confirmed that he had spoken to Mullin and that the Oklahoma Republican was not aware of the provision’s drafting.

Sen. Susan Collins (R-Maine), chair of the Senate Appropriations Committee, said she was likewise in the dark in advance of the vote.

“That was something that the leaders put into the bill, and I played no role in that whatsoever,” she told reporters.

Democrats made clear they would continue to pummel Republicans if Thune failed to take action.

Sen. Martin Heinrich (D-N.M.), the ranking member on the legislative branch appropriations subcommittee, said he was “furious” with leadership and has since introduced a bill to pare back the provision.

Sen. Chris Murphy (D-Conn.), another senior appropriator, said in an interview his party was “going to make every effort to try to reverse that pretty serious mistake.”

“I guess there’s an argument that it offers some future protection, but that’s not what the provision is about,” he said. “The provision is about a cash payout to Republican senators, plain and simple.”

Jennifer Scholtes and Meredith Lee Hill contributed to this report.