New IoT Analytics Report on the Satellite IoT Competitive Landscape Finds Increasingly Fragmented Market With Over 100 Vendors and a Shifting Market Share From Legacy Operators

Why it matters

- For satellite IoT market players: Standards like 3GPP NTN, along with governments promoting satellite connectivity with policy updates and investment, are lowering market-entry barriers for new satellite IoT operators and giving legacy operators new market opportunities. Both should look at the current landscape and trends, assess their current offerings and strategies, and adjust accordingly to remain competitive.

- For satellite IoT adopters: New technology standards and operator connectivity strategies are making satellite IoT more reliable and affordable. Adopters should learn about these standards and strategies and assess their IoT deployments, particularly in remote areas.

Introduction: Satellite IoT landscape

There were 7.5 million Satellite IoT connections in 2024, according to the latest Satellite IoT Market Report 2025–2030 (published June 2025). This number represents a mere 0.04% of the 18.8 billion global IoT connections in 2024 and just 0.17% of global cellular IoT connections. The big difference: Average revenue per user (ARPU). With typical satellite IoT plans provided by legacy players in the $40-$70 per device per month range, the ARPU for Satellite IoT is nearly 15 times that of cellular IoT, underscoring the premium nature and specialized use-cases associated with satellite-based connectivity. Satellite IoT’s revenue share relative to cellular IoT represents 3.8% in 2024 and is expected to increase in the coming years.

Technological advancements and the emergence of standardized connectivity protocols, like the 3GPP Non-terrestrial Network (NTN) standards (more on this below), are driving satellite IoT market growth by making satellite launches and services more affordable and opening the door for new satellite network operators (SNOs) to compete with long-established providers, shaking up the satellite IoT competitive landscape.

Along with market numbers, trends, and in-depth analyses of use cases and case studies, the report dedicates significant attention to the satellite IoT competitive landscape, providing an analysis of SNOs by market share, technology, orbit types, and more.

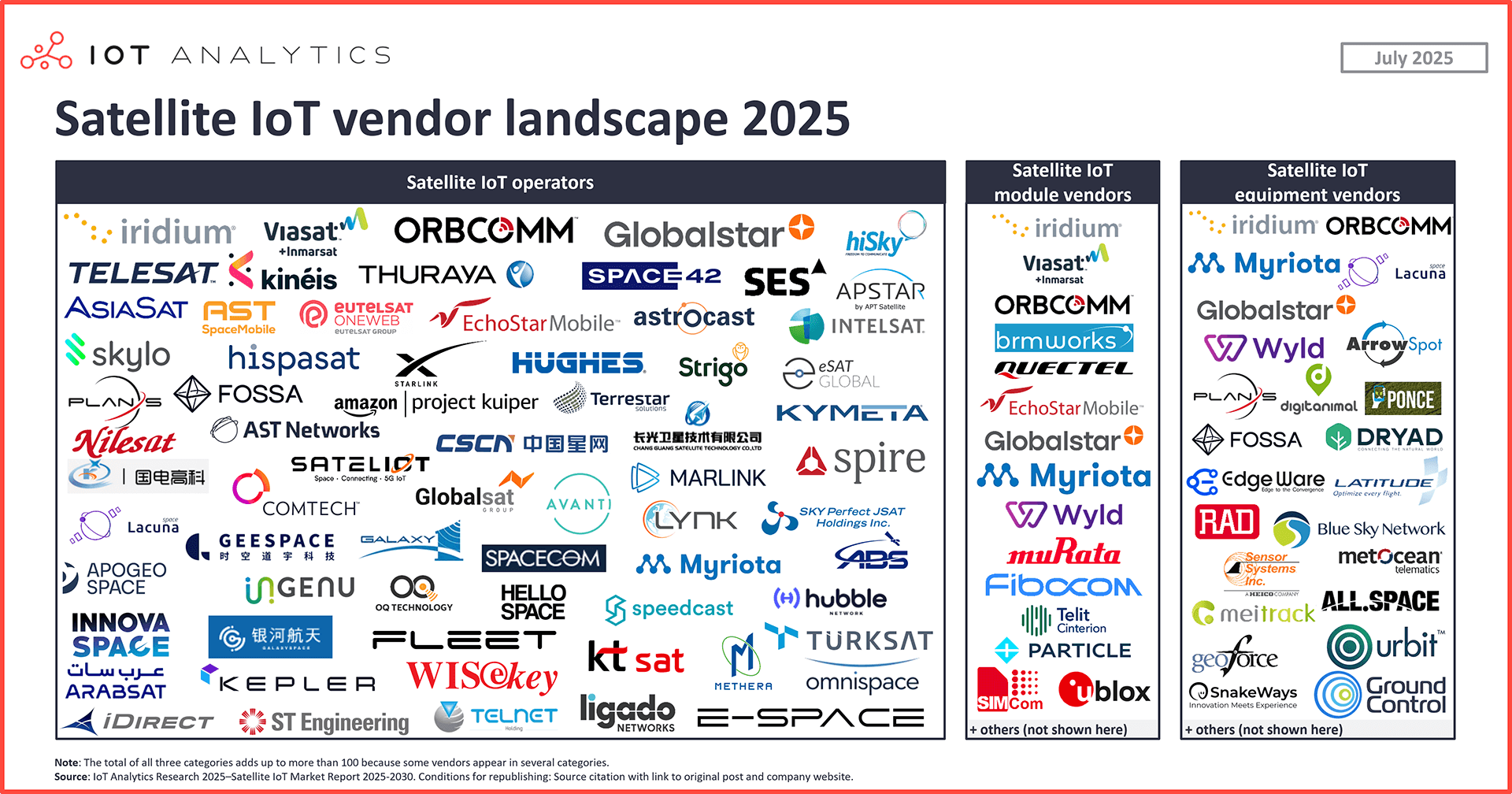

The research identified over 100 satellite IoT vendors, spread across satellite IoT operations, modules, and equipment, with some companies represented in either 2 or all 3 segments.

Here are a few notable insights about the current satellite IoT competitive landscape.

The market is becoming more fragmented

Market share of top 7 SNOs expected to drop in the coming years. In 2024, 7 legacy SNOs collectively held 80%+ of the satellite IoT market:

- Inmarsat

- Iridium

- Orbcomm

- Globalstar

- Eutelsat OneWeb

- Hispasat

- Echostar

However, by 2030, IoT Analytics expects to see several newcomers enter the list of top 7 SNOs, including US-based Starlink and Amazon’s Project Kuiper, with the share of the top 7 expected to fall through the rest of the decade. At the same time, dozens of smaller companies are entering the market, including US-based Skylo Technologies, Spain-based Sateliot, and Turkey-based Plan Space.

The race for global coverage and uninterrupted service. In November 2024, US-based SNO Viasat published its State of Industrial IoT report based on internal research and a survey of over 250 organizations. Viasat reported that 85% of respondents struggled to develop IoT solutions because of connectivity issues in target deployment areas.

IoT Analytics’ own research for the Satellite IoT Market Report 2025–2030 has found that satellite IoT operators are competing to address this issue, largely by deploying larger constellations that minimize coverage gaps and reduce satellite revisit times, aiming to deliver more reliable, always-on connectivity. This race is reshaping customer preferences, as businesses increasingly prioritize providers that offer consistent, production-quality data delivery. Customers are becoming more willing to switch to operators who can effectively address these connectivity challenges, driving dynamic changes in market leadership beyond 2025.

LEO satellite constellations lead operator orbit choice for IoT

Nearly two-thirds of satellite IoT operators use LEO. According to the report, 92% of satellites launched since 2011 have been placed in LEO, and in 2024, 63% of satellite IoT operators had constellations in LEO. These satellites, which orbit at altitudes less than 2,000 kilometers, offer significant advantages over geostationary orbit (GEO) and medium Earth orbit (MEO) satellites, particularly for IoT applications. A key benefit is low latency, or the time it takes for data to travel to and from the satellite, which is crucial in real-time IoT applications such as asset tracking and remote monitoring.

Aside from the connectivity benefits, LEO constellations have significant cost advantages in manufacturing and launching. For example, UK-based satellite manufacturer OneWeb adopted standardized mass production to efficiently manufacture 2 lightweight (147 kg) satellites daily, reducing costs through simplicity and scale. Similarly, US-based space technology company SpaceX has dramatically lowered launch expenses with its reusable Falcon 9 rocket, cutting costs to under $3,500 per kilogram.

Legacy SNOs adopting multi-orbit and hybrid strategies to maintain market lead

Legacy market players reevaluate strategies as newcomers gain. Legacy SNOs, such as US-based Viasat and Iridium, have long dominated the satellite IoT market. However, successes from market disrupters like Starlink have prompted legacy SNOs, especially those with MEO and GEO satellites (e.g., Luxembourg-based SES and France-based Eutelsat), to reassess their connectivity strategies to meet new demands, generate new revenue streams, and maintain their market leadership. In response, 2 strategies have emerged: multi-orbit and hybrid.

“The communications industry is undergoing a period of rapid change and is becoming more competitive than ever due to the entrance of large, well-financed market disrupters and other new players; new technologies increasing spectrum capacity and efficiency; rising customer demand for ubiquitous, global connectivity; and the continued convergence of the communications ecosystem.” – Nancy Eskenazi, SVP, Global Legal and Regulatory Affairs, at SES in December 2024 (source)

Multi-orbit strategy

Multi-orbit constellations help legacy SNOs expand services. Many legacy SNOs are adopting a multi-orbit strategy, primarily through partnerships and acquisitions, to leverage the strengths of each orbit type, mitigate the limitations of other orbit types, and offer a wider range of services. For instance, while LEO satellites offer low latency and cost benefits, their proximity to Earth limits their coverage area—typically 5% of the surface per pass. Meanwhile, GEO satellites can cover approximately 35% of the surface, though with higher latency. Leveraging a multi-orbit approach, SNOs can offer a wide range of connectivity services to meet the needs of IoT applications, be it low-latency communication for real-time asset tracking, coverage in remote areas where latency or throughput may not be as prioritized as coverage, or a mix of the two where GEO satellites serve as a failover mechanism during coverage gaps by LEO satellites.

An example from the report of SNOs adopting a multi-orbit strategy is Luxembourg-based SES’s acquisition of US-based SNO Intelsat, which was completed in mid-July 2025. This acquisition brings SES’s MEO constellation and Intelsat’s GEO satellites. Prior to this acquisition, Intelsat had partnered with France-based SNO Eutelsat Group for its OneWeb LEO constellation, and Eutelsat itself had merged with UK-based SNO OneWeb to form Eutelsat OneWeb in September 2023, aiming to be a combined GEO–LEO operator offering comprehensive connectivity.

The collective revenue of those who have adopted or are planning to adopt multi-orbit strategies comprised 50% share of the satellite IoT connectivity market in 2024.

Hybrid strategy

Hybrid connectivity bridges terrestrial and satellite networks. Many legacy SNOs are also partnering with mobile network operators (MNOs) to integrate terrestrial and satellite networks (hybrid network). This approach not only expands the offerings of both parties but also improves the coverage and reliability of networks. For example, if an asset tracking device equipped with cellular IoT and satellite IoT modules enters a remote area with minimal to no cellular IoT connectivity, the device can switch to satellite connectivity to maintain data flow.

In November 2023, Luxembourg-based SNO OQ Technology and o2 Telefónica, a Germany-based MNO, signed a memorandum of understanding whereby OQ Technology will contribute its LEO-based narrowband IoT (NB-IoT) satellite network and o2 Telefónica provides its cellular infrastructure and Kite IoT platform to enable seamless global NB-IoT connectivity that bridges terrestrial and satellite coverage. Similarly, Viasat and the Indian Department of Transportation to launch India’s first direct-to-device (D2D) satellite connectivity for Bharat Sanchar Nigam Limited (BSNL), a state-based MNO in India. This D2D service enabled satellite connectivity for various devices, such as smartphones, smart watches, vehicles, and industrial devices, without specialized equipment by utilizing 3GPP Release 17 standards.

Satyajit Sinha, Principal Analyst at IoT Analytics, comments that “Legacy players like Iridium and Inmarsat won’t be displaced overnight. Their continued relevance comes from a proven ability to evolve. But survival for all, especially for newer players, now depends on adapting to the new market reality: LEO collaboration, cloud-native operations, and flexible pricing models are no longer optional.The entry of tech giants like Starlink will reset expectations, and the industry must respond accordingly. With Starlink bringing over 7,000 LEO satellites into service by mid-2025, price competitiveness in the satellite market will reshape the competitive landscape by 2030.”

The post Satellite IoT competitive landscape: notable insights appeared first on IoT Business News.