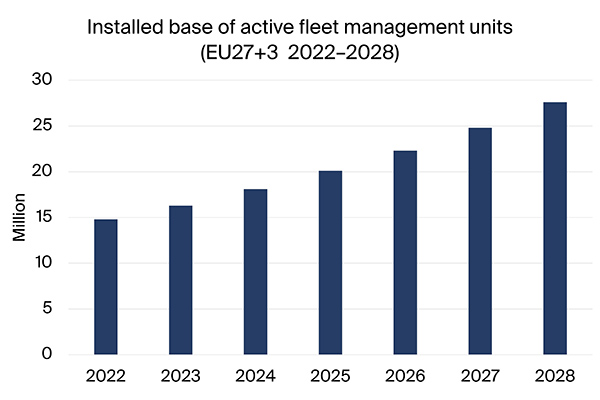

The number of active fleet management systems deployed in commercial vehicle fleets in Europe was 16.3 million at the end of 2023, according to a new research report from the IoT analyst firm Berg Insight.

Growing at a compound annual growth rate (CAGR) of 11.1 percent, this number is expected to reach 27.6 million by 2028.

The top-39 vendors have today more than 100,000 active units in Europe. Berg Insight ranks Targa Telematics as the largest player in terms of active installed base with around 801,000 units at year-end 2023. Webfleet’s subscriber base has grown both organically and by acquisitions during the past years and the company holds the position as the second largest provider of fleet management solutions on the European market and reached an installed base of about 735,000 units. Verizon Connect is in third place and had achieved an installed base of an estimated 500,000 units at the year-end. Radius Telematics and CalAmp follow and have reached 459,000 units and 420,000 units respectively. Scania, ABAX, Geotab, Gurtam and Microlise are also ranked among the ten largest providers with 280,000–420,000 units each. Some notable players just outside of the top ten list are AddSecure Smart Transport, Bornemann, Volvo Group, MICHELIN Connected Fleet, Eurowag Telematics, SCALAR by ZF, Quartix, Linqo, MAN, RAM Tracking, Optimum Automotive, Daimler Truck, Mapon, Cartrack, Océan (Orange), GSFleet, Trimble, Fleet Complete, Macnil, AROBS Transilvania Software, Actia Telematics Services, Infobric Fleet, DAF and Shiftmove.

The HCV manufacturers are now growing their subscriber bases in Europe considerably thanks to standard line fitment of fleet management solutions. FleetBoard by Daimler Truck, MAN DigitalServices, Volvo Connect and Scania Fleet Management are the most successful with active subscriber bases of 170,000 units, 205,000 units, 260,000 units and 418,000 units in Europe respectively at the end of 2023.

The consolidation trend on this market continued in 2024.

Johan Fagerberg, Principal Analyst, Berg Insight, said:

“Fourteen mergers and acquisitions have taken place so far this year among the vendors of fleet management systems in Europe.”

In June, AddSecure acquired Astrata Europe. In the same month, FleetGO Group acquired Dutch-based software provider Data2Track with the support of Main Capital Partners. Mapon acquired Trackon Fleet Management based in Lithuania. EcoMobility Group acquired WinFleet based in France and Schmitz Cargobull acquired a majority stake in Atlantis Global System in June. In July, Cubo based in Northern Ireland was acquired by Fuel Card Services, one of the largest fuel card providers in the UK. Fagor Electronica acquired Sateliun in September. In the same month, Alerce Group acquired Wemob, and GSMvalve acquired Latvia-based SkyFMS. In September, Inseego announced the sale of its fleet management and telematics business for US$ 52 million. The buyer is a portfolio holding company of Convergence Partners, an investment management firm focused on the technology sector. In September, Powerfleet announced the acquisition of Fleet Complete. The deal valued at US$ 200 million creates a combined entity with over 2.6 million subscribers and 2,500 employees. Trimble announced in September that Platform Science will acquire its global transportation telematics business units. As part of this agreement, Trimble will become a shareholder in Platform Science’s expanded business (32.5 percent). In October, Shiftmove acquired Optimum Automotive that operates in France, Portugal, Spain and Africa. Finally, Great Hill Partners announced in October a partial sale of BigChange to Simpro Group, a global provider of field service management solutions. Mr. Fagerberg anticipates that the market consolidation of the still overcrowded industry will continue in 2025.

The post The installed base of fleet management systems in Europe will reach 27.6 million by 2028 appeared first on IoT Business News.